Table of Contents

Heir search has proven to be practical for probate attorneys who wish to mitigate inheritance disputes with finality. Learning from prominent disputed inheritance cases like Michael Jackson’s, Jimi Hendrix’s, Charles Manson’s, and Leona Helmsley, no probate attorney wants to see estate settlement remain on probate for decades.

Luckily, as a probate attorney, you can mitigate most, if not all, potential inheritance disputes if you leverage heir search. These services ensure you have everything researched and well-documented, leaving no room for fraud, left-out heirs, or missing records.

Below is a detailed look at heir search services and how they can keep your probate process conflict-free.

How Will Heir Search Help Mitigate Inheritance Disputes?

By incorporating heir search services as a probate attorney, you will have met all the legal requirements and saved time and money.

Here is a detailed look at the several areas through which heir search will help mitigate inheritance disputes:

1. Helps Identify Potential Heirs

Heir search for estate distribution can help locate missing heirs

When the decedent dies intestate or has an invalid or contested Will, heir search moves in to quell any roots of conflict by conducting a thorough genealogy investigation to identify the estate’s rightful heirs.

According to the laws of intestacy, the estate must be distributed according to the table of consanguinity, which typically prioritizes the spouse, children, parents, siblings, and other relatives.

So, as soon as probate is granted, the probate attorney must establish who the heirs are and notify them of the commencement of the probate process and their rights to inherit. By incorporating heir search, the probate attorney starts on the right footing to resolve disputes regarding the estate or their conduct.

2. Finds Unknown and Missing Heirs

finding unknown heirs

Missing or unknown heirs can be a source of inheritance disputes, especially if left out during estate distribution. In this case, the probate attorney risks litigation due to breach of fiduciary and potential damages to compensate for the unaccounted heirs’ share.

In the worst-case scenario, the emergence of an heir could cause conflicts due to unfair mistreatment. However, with heir research, the probate attorney can avoid such an occurrence by quickly telling the probability, location, and fate of a missing or unknown heir.

Heir search service providers conduct in-depth research on the decedent’s heirline and document their findings in a way that’s admissible in court.

3. Solves Complex Family Trees

Heirship verification challenges can become a brick wall especially with complex family structures

Blended families, adopted children, and multiple marriages can be recipes for inheritance disputes, especially if there’s no Will or if it’s invalidated. Proceeding with such a probate case would be a hassle for a probate attorney. They would need to clearly understand the family structure and table of consanguinity before distributing the estate. This is where heir search comes in.

The search involves forensic genealogy incorporating advanced methodologies like DNA to establish kinship and verify heirship. A comprehensive heir search report makes it hassle-free for the probate attorney to understand who inherits what and to make the case before the jury.

4. Counter Fraud

Working with heir search professionals can help track and stop probate fraud

Fraud in the probate process could breed disputes as different parties try to prove their point. While probate fraud could take many shapes, heir search can help stop fraudulent claims against an estate.

A researcher can help the attorney determine which heir is legitimate based on birth certificates, adoption records, marriage certificates, DNA tests, and other evidence in the heir search report.

What Are the Most Common Causes of Estate Battles

While Estate battles can have divergent reasons, we have captured the most likely scenarios. Understanding these causes could be a significant step in knowing how to prevent or resolve them.

1. Dying Without a Will

A will

Dying without a Will a.k.a., dying intestate and can be a major reason for conflict in estate settlement. The lack of a Will or any other legally binding agreement leaves the entire estate in limbo without clear instructions on who should own what and when.

When a person dies intestate, the estate is subject to the laws of intestacy and the probate process. In this case, the probate court takes over the matter. It appoints the estate administrator, who should take account of every asset and establish all the rightful beneficiaries and heirs.

While the probate process seeks to streamline estate settlement, it could have to deal with family dynamics, introducing illegitimate children and half-siblings into the picture. The more disputes in such a process, the longer it would take for every heir to receive their share.

2. Sibling Rivalry

Conflicts are common in estate planning involving siblings

Sibling rivalry is a common phenomenon not only in estate settlement but also in other aspects of life. However, extreme sibling rivalry could lead to estate battles if mediation is ineffective and timely.

When there is bad blood between siblings, agreeing on simple matters like property distribution or the probate course becomes harder. Besides, the rivalry could lead to numerous injunctions when executing the Will or during the probate process.

Most of the time, sibling rivalry stems from childhood or new circumstances introduced by the death of an estate owner or estate distribution. A small issue could become a massive estate battle for years without the appropriate mediation to address underlying issues.

3. Economic Disparity Among Beneficiaries

Economic standing is also key

When there is a substantial economic disparity among the beneficiaries, estate disputes are likely to arise as the distribution may appear inconsiderate to some. The beneficiaries with less economic value may feel unfairly mistreated when those who are economically well-off appear to receive more from the estate.

Besides, most beneficiaries have accused the Trustees, executors, or testators of favoring some beneficiaries through special allocations and appointments. However, it is worth noting that the decision to give more to some beneficiaries is within the testator’s right based on reasons known to them.

Since the needs of each beneficiary may also differ, they are likely to prefer conflicting solutions in estate settlement. An economically stable beneficiary would prefer property maintenance to add value for future sales, while others would prefer immediate liquidation.

4. Co-Trustees and Co-Executors

Choose wisely

Having more than one estate executor or personal representative (PR) is recommended when you want assurance that the estate will be distributed according to your wishes. The same goes for having a backup Trustee who works with a colleague to settle your estate.

Unfortunately, having multiple trustees or executors could lead to disagreements among the parties on the best way to handle an estate. While these professionals are expected to reach a consensus on several issues, a fraction of disagreement could spiral into a blown-out dispute.

The matter could worsen when the executor or a Trust has some interest in the estate or is a beneficiary or a sibling. If the issues cannot be resolved, it may delay estate settlement and any litigation to remove the executor, further complicating things.

5. Cases of Dependency, Mental Illness, or Incapacity

Mental incapacity

An estate settlement setting that mishandles sensitive cases like dealing with dependents, minors, and mental incapacity is a recipe for disaster. When a beneficiary trustee, testator, or any other interested party falls under this category, estate settlement could take a different route and encourage disputes.

Beneficiaries may base their disputes on the fact that one party was dependent, mentally ill, or incapacitated, making any provisions in a Will or Trust invalid. When taken to a probate court, such matters can lead to prolonged probate processes and an overhaul of the estate settlement plans.

For instance, in the case of end-of-life care, the estate owner is generally under the care and control of a chosen people, if not one. As a result, cases of elder abuse are prevalent in this situation as the caregiver tries to influence the patient for personal gain.

So, when one of the caregivers is interested in an estate settlement, other beneficiaries may fall victim to litigation for alleged undue influence to have the estate planned in a certain way.

6. Estrangement or Disinheritance

Confirmed heirs are entitled to inherit too

When successors or heirs are left out of the estate plan, they will likely challenge their exclusion, making a prolonged court battle imminent. Similarly, unknown or missing heirs could emerge during the probate process and prove their right to be part of the estate beneficiaries.

Additional heirs emerging during estate settlement are common in blended families and secretive relationships. According to the laws of intestacy, the estate administrator must consult a probate researcher to identify all the potential heirs of the estate. The emergence of more heirs is likely to cause a battle between families and beneficiaries.

Even when the decedent dies testate, estranged spouses and children may still contest the Will and have their interests considered before the executor distributes the assets.

How To Mitigate Inheritance Disputes During Estate Planning

Estate battles are common in estate settlements and can result in lengthy and costly legal actions. Therefore, estate and probate attorneys should help parents and property owners find ways to prevent contests or disputes during probate and estate distribution.

Here are a few steps estate owners can take to prevent estate battles in your estate settlement:

1. Seek Professional Advice

Be professional

The most important thing is understanding the dynamics of estate settlements and all the likely scenarios. Therefore, it is imperative for the estate owners to consult a professional, especially if they suspect that their estate planning could lead to disagreements and court battles.

The first professional would be an estate plan attorney to help draft those Trust documents and Wills per the law. An estate planning attorney ensures that they include crucial elements in the Will or Trust and that the entire agreement is adequately executed without any cause for alarm.

Of course other professionals to consider may include probate attorneys to prepare the estate for the probate process while heir researchers would create a comprehensive genealogy that shows all the potential heirs and beneficiaries.

2. Plan The Estate on Time

The earlier the better

Creating Trusts and Wills when the estate owner has the capacity is advisable, as doing it later can be challenging. Creating the plan when they’re already under critical care and have mental capacity issues could encourage interested parties to contest the plan based on undue influence and lack of the necessary capacity.

3. Avoid Signs of Influence

Siblings

It is common for parents or estate owners to have their eldest children, or close relatives cater to different forms of their activities, such as making appointments with the attorney or making personal decisions without a formal agreement.

Other beneficiaries may find this practice suspicious and could contest a Will or Trust based on undue influence. So, whether there was influence or not, parties may present substantial evidence before the probate court and see the entire process marred with unending conflicts and hatred.

For this reason, estate owners and their attorneys should not let anyone influence the estate plan in any way and avoid leaving an unexplained bequest to them. If they must favor one party over another, it would be advisable to communicate the rationale to mitigate inheritance disputes.

4. Consider Using Trusts

Trusts

Trusts are an alternative estate planning tool that, unlike Will, keeps details private and doesn’t have to go through the probate process. So, if you suspect that there would be a dispute to the estate, it’s wise to open a Trust to protect beneficiaries from the tedious and costly litigations.

Normally, Trusts take effect immediately and do not have to wait till the death of a grantor. Therefore, beneficiaries are introduced to the estate plan terms early and can raise any concerns with the grantor when they’re still alive.

Besides, assets granted to an irrevocable Trust are no longer considered property to the grantor. They, hence, may not be affected even after death.

5. Mediate

mediation saves time, energy, and money

If you’re a beneficiary of an estate and want to preserve sibling harmony, some of the most critical actions include using a mediator, liquidating assets, and deferring to an independent fiduciary.

A neutral professional mediator can be a game-changer in handling estate battles as they can bring all the warring parties together and help reach a consensus. Similarly, deciding to liquidate and spit the proceeds can solve issues surrounding assets and heirs’ property.

Most importantly, siblings should decline or revoke their appointments as Trustees or executors and choose an independent professional to decide on asset distribution. Being a Trustee or executor over your siblings will likely cause friction, and it is wise to let a neutral professional take on the matter.

However, the decline or revocation should only happen when other siblings agree on the same, depending on the estate’s ability to pay for such services.

Benefits of Using Heir Search to Mitigate Inheritance Disputes

A file image of a lawyer’s joy after overcoming a probate puzzle

Of course, the primary benefit of heir search in this case is to lead to a peaceful and amicable probate process. In addition, having everything in order will save money and a lot of time on the dreaded long probate process.

Below are other benefits probate attorneys reap from incorporating heir search to mitigate inheritance disputes.

- You prevent legal challenges, fines, disbarments, and imprisonment that could arise from mishandling the estate or probate process.

- Heir search streamlines the process, expediting the probate process and ensuring equitable estate distribution to all beneficiaries.

- A comprehensive forensic genealogical report minimizes the risks of errors that could lead to more litigation, costs, and delays.

- A streamlined probate process saves the family and the other involved parties the stress and emotional turmoil that could emanate from disputes and shambled estate settlement.

- Conducting thorough heir search and mitigating inheritance disputes helps maintain your reputation as a professional probate attorney. It also shows your commitment to a high level of service and expertise.

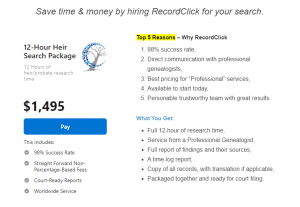

Save Time & Money by Hiring RecordClick for Your Search

Reasons you should consider seeking RecordClick’s services

RecordClick will help you mitigate inheritance disputes with heir search through in-depth local and international forensic research, non-percentage flat-rate fees, over 98% success rate, and well-documented court-ready reports. Plus, if needed, we can appear in court for testimonies.

Our professional genealogical researchers have completed tens of thousands of searches traversing various cultures, languages, and legal intricacies.

Here’s what to expect with Record Click’s heir search service:

Record Click’s heirline researchers work with and assist the attorney in finding the missing heirs to an estate. We document the evidence to validate the locating of missing heirs to an estate and provide the attorney with the necessary documents.

1. Heir Search When Estate Beneficiaries are Unknown

We can help when the estate beneficiaries are unknown, need to be located, or need proof of the relationship. We provide a simple hourly rate and do not expect or require a percentage of the estate.

2. Heir Search Experience & Credentials

We have experienced, credentialed researchers all over the USA, including in Salt Lake City, UT, the world-famous Family History Library, and international genealogical search expertise. Our researchers also have access to the constantly growing world of subscription internet services.

After your research, your report and all your records will be provided in an attractive binder.

3. Customize Based on Your Heir Search Needs

Our experts can customize your heir search for the genealogical research you need for your firm, your time frame, and your budget. Contact us today to get started on your estate settlement.

For local and international services or heir searches, firms, attorneys, and trust officers rely on Record Click for their work.

Our team of 45+ experts includes a former CIA agent, in-house DNA experts, researchers in all states, and researchers in all parts of Europe. Services included: heir German, heir search, search for heirs, heir searches, heir finders, heir finder, heir in German.

Save time and money with RecordClick heir search

Save money and time; we have the best pricing in the industry, and we’re available to start today. We’ll help you solve the unknown in your case. Please reach out to us today for more information.

We offer free, no-obligation consultations, even if you are not planning to start a search immediately.

Feel free to ask any questions — we look forward to connecting.

Contact Record Click today or schedule a call.

READ MORE: Record Click’s Heir Research Services, Costs, And Expectations.